Regulation

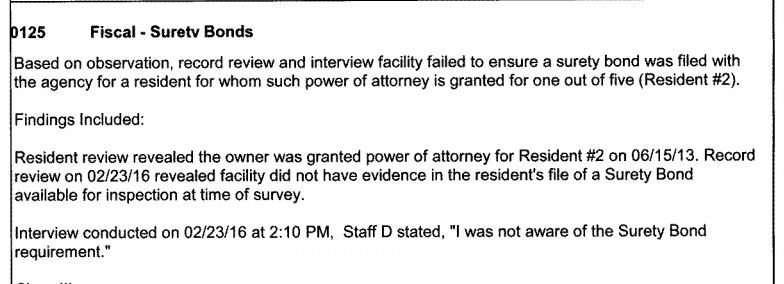

Title Fiscal – Surety Bonds

Statute or Rule 429.27(2) FS; 58A-5.021(3) FAC

Type Rule ST – A0125 – Fiscal – Surety Bonds 429.27

(2) A facility, or an owner, administrator, employee, or representative thereof, may not act as the guardian, trustee, or conservator for any resident of the assisted living facility or any of such resident ‘ s property. An owner, administrator, or staff member, or representative thereof, may not act as a competent resident ‘ s payee for social security, veteran ‘ s, or railroad benefits without the consent of the resident. Any facility whose owner, administrator, or staff, or representative thereof, serves as representative payee for any resident of the facility shall file a surety bond with the agency in an amount equal to twice the average monthly aggregate income or personal funds due to residents, or expendable for their account, which are received by a facility.

Any facility whose owner, administrator, or staff, or a representative thereof, is granted power of attorney for any resident of the facility shall file a surety bond with the agency for each resident for whom such power of attorney is granted. The surety bond shall be in an amount equal to twice the average monthly income of the resident, plus the value of any resident ‘ s property under the control of the attorney in fact. The bond shall be executed by the facility as principal and a licensed surety company. The bond shall be conditioned upon the faithful compliance of the facility with this section and shall run to the agency for the benefit of any resident who suffers a financial loss as a result of the misuse or misappropriation by a facility of funds held pursuant to this subsection. Any surety company that cancels or does not renew the bond of any licensee shall notify the agency in writing not less than 30 days in advance of such action, giving the reason for the cancellation or nonrenewal. Any facility owner, administrator, or staff, or representative thereof, who is granted power of attorney for any resident of the facility shall, on a monthly basis, be required to provide the resident a written statement of any transaction made on behalf of the resident pursuant to this subsection, and a copy of such statement given to the resident shall be retained in each resident ‘ s file and available for agency inspection

58A-5.021 (3) SURETY BONDS. Pursuant to the requirements of Section 429.27(2), F.S.: (a) For entities that own more than one facility in the state, one surety bond may be purchased to cover the needs of all residents served by the entities. (b) The following additional bonding requirements apply to facilities serving residents receiving OSS:1. If serving as a representative payee for a resident receiving OSS, the minimum bond proceeds must equal twice the value of the resident ‘ s monthly aggregate income, which must include any supplemental security income or social security disability income plus the OSS payments, including the personal needs allowance. 2. If holding a power of attorney for a resident receiving OSS, the minimum bond proceeds must equal twice the value of the resident ‘ s monthly aggregate income, which must include any supplemental security income or social security disability income; the OSS payments, including the personal allowance; plus the value of any property belonging to a resident held at the facility. (c) Upon the annual issuance of a new bond or continuation bond, the facility must file a copy of the bond with the Agency Central Office.

Simplified

1.If the owner or administrator or anyone employed by the facility become appointed by Social Security to become a Competent Residents Direct Care Payee the facility must get in writing the approval from that Competent resident and be able to produce this document to AHCA if requested.

2..If the owner or administrator or anyone employed by the facility becomes the resident’s payee the facility must file a surety bond with AHCA in the amount of twice the resident’s monthly income.

3. If facility staff is the representative payee for a resident receiving OSS, you must get a bond that must equal twice the value of the resident ‘ s monthly aggregate income, which must include any supplemental security income or social security disability income plus the OSS payments, including the personal needs allowance.

4. .If the owner or administrator or anyone employed by the facility for any resident the facility becomes Power of Attorney for a resident then a surety bond needs to be obtained and filed with AHCA for that resident.

5. Once a surety bond cancels or is not renewed you must notify AHCA 30 days prior to the bond being canceled.

6. If the owner or administrator is granted Power of Attorney you are required to provide the resident a written statement of any transaction made on the behalf of the resident and be given to the resident and placed in the resident’s file available to AHCA.

How Do You Get A Surety Bond?

Most Insurance companies can issue Surety Bonds. You can even check with your facilities Liability Insurance company as more than likely they do. Or you can google Surety Bonds and you will get a list of companies who do.

What is the Cost?

A Surety Bond for a resident paying 1,300 a month you are looking at anywhere between $50 to $100 per year

Take the time and review your residents and identify which resident’s the facility is the direct payee or power of attorney for and make sure you have Surety Bonds for them and if they are up to date.

Make sure your resident records have the written consent from the Resident and that you are providing the resident monthly documentation of the management of their funds.